|

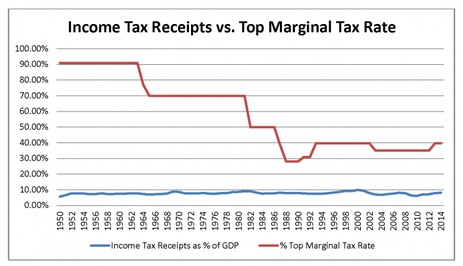

I came to the conclusion in my teens that there is a very ethical expectation that the moment one has MORE than enough money to accommodate most anything one could hope to do in this world, it would be very reasonable to expect them to be taxed higher on those HIGHER earnings. It wouldn't be until many years later that I realized most first world countries already have that and it's called "progressive tax brackets". Now, mind you, people are not taxed more on the first sums of money they make, they are only taxed more when the money they make exceeds these levels of extreme riches. Someone making $250,001 a year is only taxed at the rate applied to people making more than 250,000 on that final single $1. (Ignoring this fact alone accounts for most misconceptions or straw-man arguments about this topic.) But that's almost beside the point. I stated above "MORE than enough money". In my eyes as a teen that number would have probably been around $100,000 a year; which would be around the 70th percentile of households in America. As an adult, and accounting for inflation, experience and understanding how expensive cost of living in certain regions of the country are, I would probably plop that number closer to $250,000; placing families in only the 3rd highest tax bracket and in the top 10% of earners. Before 1964 the top tax rate was as high as 90% on the top dollars earned. Before Reaganomics in the 1980s, it was at 50%. Our idea of what is "fair" is very relative as this country existed for decades with top tax rates on top dollars as just mentioned. And in those eras, we saw a level distribution of wealth as our economy grew. Quality of life and wages along all levels of society progressed TOGETHER. But when we have had an economy that has pooled more than 90% of economic growth into the top 1% for decades, while the bottom 98% has been stagnant (consider that that includes the 98th percentile), it becomes atrocious to think about why, how, and what damage it does to have all net gains going into the hands of a distant different elite. A vast amount of that money is being removed from the functional economy when it is pooled away like this. This all paints quite a picture without even getting into basic ethical thoughts like "Are these people really producing 10,000x more "productivity" than I am as a common worker?" or "Are day-traders adding ANYTHING to society?" These questions are laughable at how grotesque the answers seem to me.

So, when I consider all this, and then I consider the counter point is "I don't think it's right to "take" money from Billionaires", I find (first) this to be a poorly phrased representation of what the conversation is really about, and (second) a meaningless counterpoint that doesn't account for any broader ideas of society, ethics, life and economies. When you account for all the needs of society, all the greed of corporations and humanity, the statistics of the last 50 years, countless Scandinavian examples of how society can look, and the fact that these top 1% oligarchs are the ones we are allowing to rewrite laws, legislation and tax brackets, as we the people don't blink an eye(!), it becomes impossible to GIVE A FUCK about vague arguments of "fairness" in response to higher taxes on the higher tax brackets to help our roads get built, pay for military, potentially re-fund social security, or join the rest of the civilized world by providing health care to our citizens. In short: Higher tax brackets are very justified because we live in a SOCIETY and any non-toxic person only needs to own like 3 mansions, max. Which would cost, what? 10 Million Dollars? 20 Million? Barely qualifies as a 1%-er at that point, and that's worth keeping in mind. “It’s only called Class Warfare when the poor fight back.” |

The Author

is a thirty-something guy who hasn't been able to look away from politics since 2010. Around the time he got tired of staring at religion. Archives

June 2020

Categories

|

RSS Feed

RSS Feed